Presenter: Damla Öz

Affiliation(s): University of Manitoba, Departmant of Agribusiness and Agricultural Economics

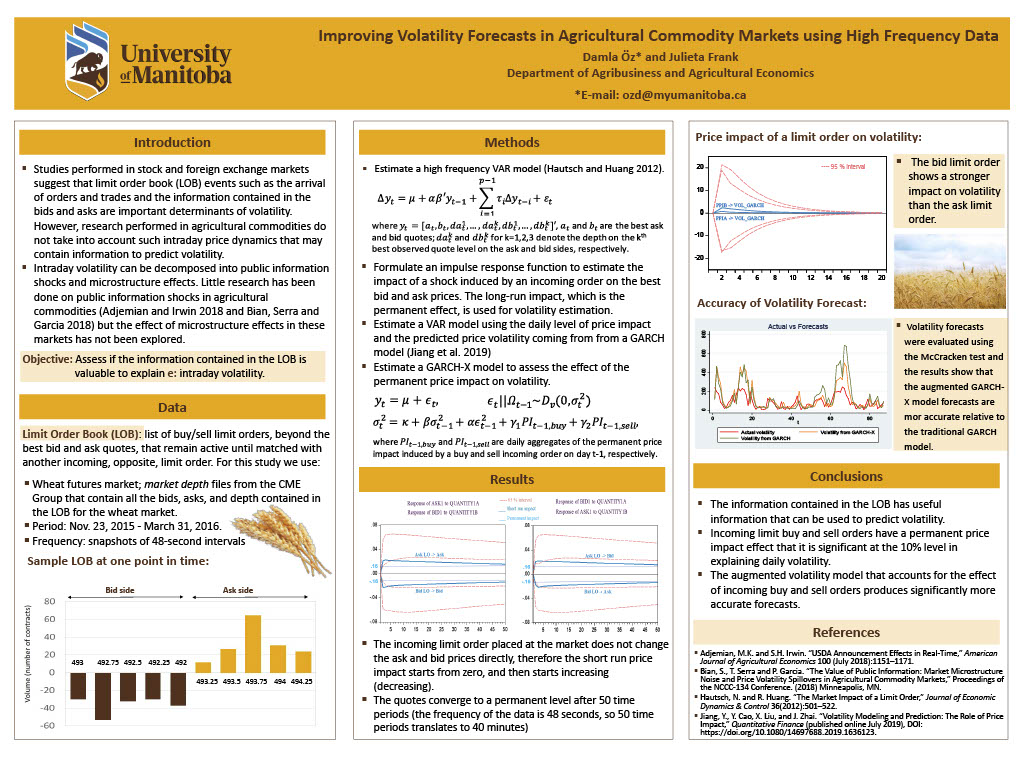

Poster Title: Improving Volatility Forecasts in Agricultural Commodity Markets using High Frequency Data

Authors: Damla Öz, Julieta Frank

Abstract:

Volatility in agricultural markets has been studied extensively. The vast majority of the research was performed using daily data, which was the highest data frequency available. In recent years, however, agricultural markets shifted to the electronic platform, which brought important changes in price dynamics due to microstructure effects. In the electronic market, traders submit limit buy or sell orders to the exchange where a centralized computer system places them in the limit order book (LOB). Very few volatility studies have been performed in agricultural markets using intraday data to capture the new price dynamics, and those studies were performed using intraday returns. Other variables that may contain information, such as bid and ask prices and depth in the LOB, have not been incorporated in volatility models in these markets. We argue that the information contained in the LOB may be valuable to explain intraday volatility in agricultural markets such as corn, soybeans, wheat, live cattle, and hogs. Research performed in stock and foreign exchange markets suggests that LOB events such as the arrival of orders and trades and the information contained in the bids and asks are important determinants of volatility. With this research we expect to shed light on the determinants of volatility in agricultural markets at the microstructure level, and therefore provide a better understanding of the price dynamics in the new electronic trading environment. The results of the research will be useful for futures market participants such as hedgers and day traders to manage their price risk.

Click to view full PDF: